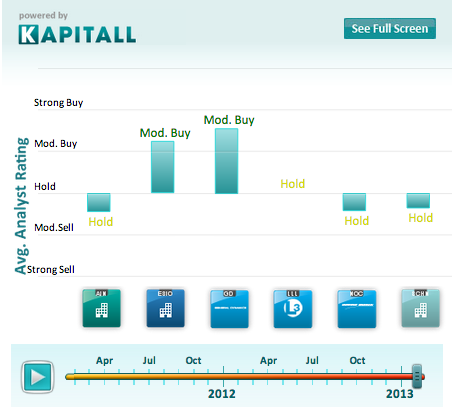

Forecasting generally looks at the current position of the company, and is subject to today’s market assumptions.

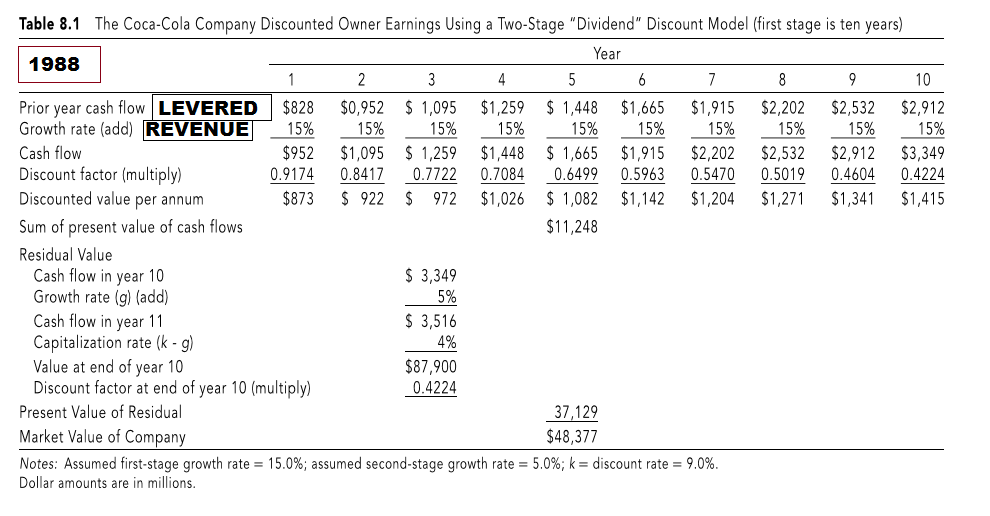

Unlevered to levered cashflows free#

Simulating future growth patterns can be almost impossible when using free cash flow. To combat this problem, analysts tend to look at the overall FCF trend, and discount one-off anomalies. This may or may not be cause for concern to prudent business management. If a company has recently invested in new equipment to support growth and ultimately has pushed the FCF into the red - this would come up as a warning signal for an investor. Once again changes in working capital and CAPEX are subtracted from net income.įrom a reporting perspective, free cash flow can be bumpy at times and is open to interpretation.

To ensure that we do not include any write-downs, such as X, Y, or Z, in the calculation, we need to account for depreciation and amortization, X and Y, respectively. The net income method is used when the balance sheet and income statement are available. _Net Income + Depreciation and Amortization – Changes in Working Capital – Capital Expenditure When calculating the FCF from the income statement, it is important to add interest costs into net profit before subtracting changes in working capital (current assets – current liabilities), net capital expenditure ( CAPEX – depreciation), and tax shield ( marginal tax rate x interest). _Net Profit + Interest – Changes in Working Capital – Net Capital Expenditure – Tax Shield It essentially strips out the expenses associated with the purchase, improvement, or maintenance of long-term assets, which includes the land, building, and equipment costs from available cash.

Using the cash flow statement, the operating activities method is simple and does not require additional calculation. _Cash Flow from Operating Activities - Capital Expenditure = Free Cash Flow Each method has a slightly different workaround and degree of complexity. Several formulas can be used to calculate free cash flow.

0 kommentar(er)

0 kommentar(er)